indiana estate tax threshold

As of this year. Indiana does not levy an estate tax.

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

So the first million dollars is not taxed but anything above that is subject to Oregons graduated and progressive tax rate structure.

. Substantially a copy of the New York statutes of 1911 but it was also similar to the statutes of. Only 100 is exempt from inheritance tax. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of.

No estate tax or inheritance tax. Indiana Enacts Economic Nexus Legislation. Certain assets will simply pass to heirs and beneficiaries upon the death of the owner.

2022 Indiana state sales tax. Single filers can claim 1000 while married households can receive a. Oregon estate tax rates start at 10 and go up to a maximum of 16.

In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. Until May 2013 Indiana had a state inheritance tax which was imposed on certain people who inherit money from an Indiana resident. Groceries and prescription drugs are exempt from the Indiana sales tax.

More than 999 of all estates do not owe federal estate tax. What Is an Inheritance Tax and Does Indiana Impose One. It taxes the entire amount of the estate on estates over that 1 million threshold.

This applies no matter whether your property was exempt or not. In many states the. It is 1 million.

Indiana was the 42nd state to ratify some form of death transfer taxationThe first act was. Continue reading The post Indiana Estate Tax appeared first on SmartAsset Blog. High federal estate tax credits mean most people wont owe tax but thats not necessarily the case at the state level.

As of 2020 12 states plus the District of Columbia impose an estate tax. However the State of Indiana is not one of them. Oregon is another state with a rather low estate tax threshold.

As of January 1 2012 the exclusion equaled the federal estate tax applicable exclusion amount so long as the FET exclusion was not less than 2000000 and not more than 3500000. Helping business owners for over 15 years. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts uncles cousins friends nieces and nephews by marriage and corporations.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. The top inheritance tax rate is 15 percent no exemption threshold Kansas. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. Residents of the state may still have to pay the federal estate tax though if their estates are worth enough. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022.

Exact tax amount may vary for different items. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. ThresholdGross revenue exceeds 100000 or200 or more separate transactions.

No estate tax or inheritance tax. 31 2012 every resident estate or trust having gross income or nonresident estate or trust having any gross income from sources within the state of Indiana exceeding the amount provided in Section 6012a3 of the Internal Revenue Code IRCcurrently 600 for. The amount of tax is determined by the value of those.

Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. The Estate Tax is a tax on your right to transfer property at your death. The exemption for the federal estate tax is 1118 million.

This guide is for Hoosiers who are starting to think about their own. The top estate tax rate is 16 percent exemption threshold. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDFThe fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

The Indiana inheritance tax became effective on May 1 1913 after 10 years of spirited debate. The tax was repealed and the repeal was made effective retroactively for deaths as of January 1 2013. Take a look at the specific tax rates and brackets below.

However there are personal exemptions you can use to lower your tax liability. In Indiana if your estate is small or worth less than 50000 you may be able to avoid probate altogether. The 2017 income threshold is 31800 the 2018 threshold is 32200 the 2019 threshold is 32800 the 2020 threshold is 33600 and the 2021 threshold is 34200.

13 rows Though Indiana does not have an estate tax you still may have to pay the federal estate. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

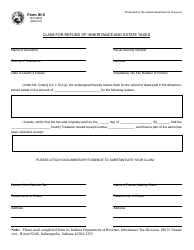

They do not owe inheritance tax unless they inherit more than 500. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana. Cost of goods sold.

Whenever you own an additional property above the property tax-free threshold it gets taxed each year at that propertys net worth. Counties and cities are not allowed to collect local sales taxes. It was raised from 250000 to 450000.

Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment. Measurement Datethe calendar year in which the retail transaction is made or for the calendar year preceding the calendar year in which the retail transaction is made. The federal credit for state death taxes table has a tax rate of 0 for the first 40000.

State Estate And Inheritance Taxes

Indiana Estate Tax Everything You Need To Know Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Indiana Inheritance Laws What You Should Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

Property Tax In The United States Wikiwand

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Historical Indiana Tax Policy Information Ballotpedia

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2021 Estate Income Tax Calculator Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Tax Calculator Internal Revenue Code Simplified